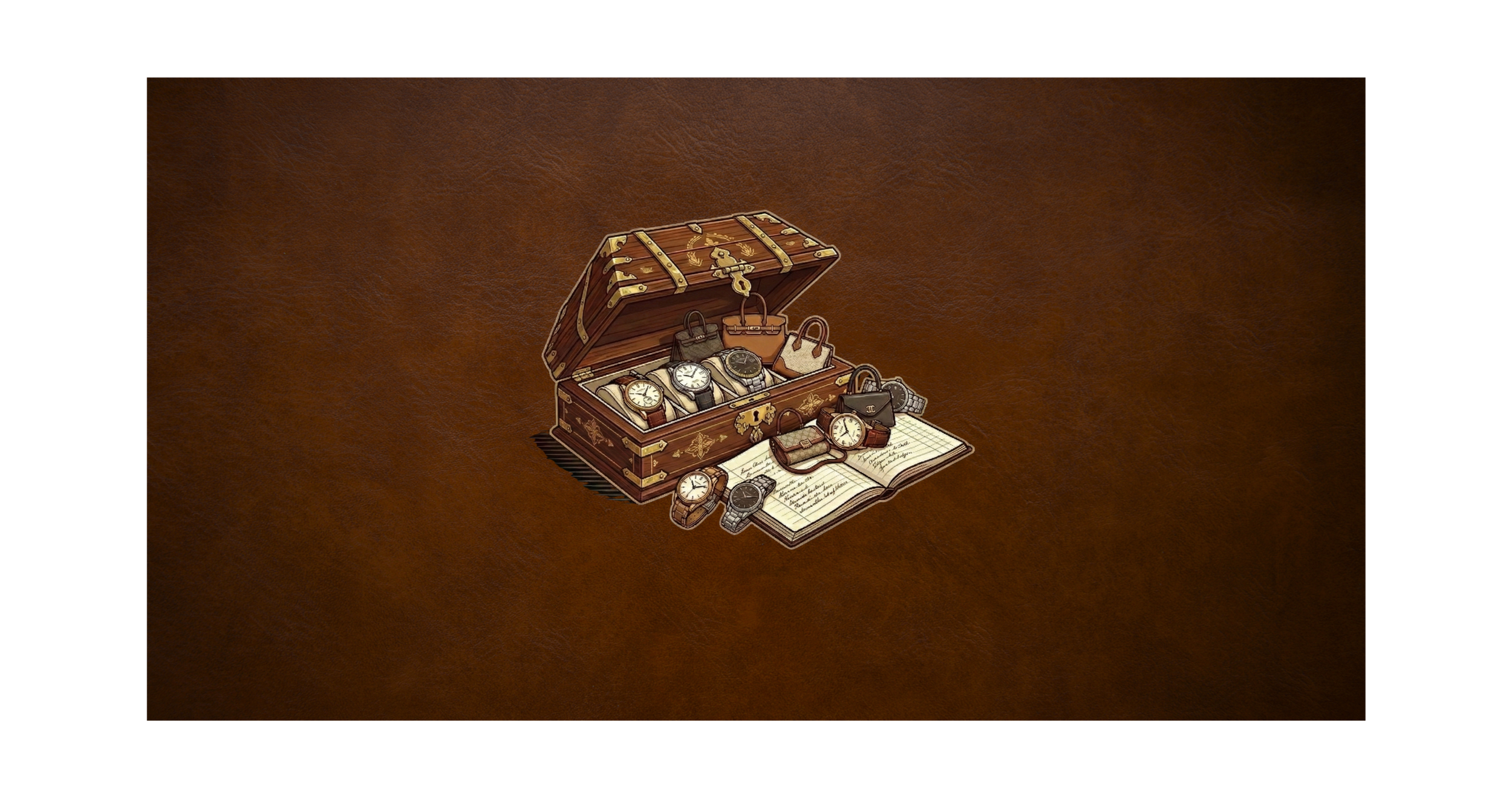

WEALTH PRESERVATION THROUGH HARD ASSETS

CURATING TIMELESS VALUE

Data-driven advisory for the acquisition, preservation, and liquidation of investment-grade timepieces and handbags.

The Asset Class Index

The Safe Haven

Liquidity and Preservation. Blue-chip assets (Rolex, Hermès) that historically outperform inflation.

Aggressive Growth

Speculation and Yield. High-volatility assets and fractional ownership for maximum ROI.

Quiet Luxury

Heritage and Retention. Under-the-radar assets for the discerning collector.

From The Archive

Market Intelligence

Historical data, research, and a record of value over time.

Provenance Protocols

Scrutiny, inspection, and the rigorous process of authentication.

Concierge

Access beyond the waitlist

For the collector seeking specific allocations—whether a birth-year Submariner or a Quota Bag—our concierge desk leverages a global network of verified dealers to secure assets that are otherwise unobtainable.

Maximize your exit

Liquidity is the hallmark of a true asset. When it is time to exit a position, we ensure your assets are positioned to command market-leading returns.

We believe that true luxury is not consumed; it is held. In an era of volatility, investment-grade timepieces and heritage leather goods offer a unique hedge against inflation—provided they are acquired at the right entry point.

The Vault & Ledger exists to filter the signal from the noise. We combine historical market data with concierge-level sourcing to build portfolios that protect wealth and define legacy.

Follow Us On Social